Jump-start your account setup by having all or part of your check deposited to your checking or savings account every month. Plus, you'll get paid up to two days early!

Set up direct deposit today to get your paycheck up to two days sooner!

This new account guide will help you finish setting up your account. Click through the steps below to help make the most of your new membership.

As a first step, be sure to add ACU of Texas as a contact in your phone. By adding our number to your phone, you'll have the convenience of reaching us with just a tap. Whether you're at the grocery store or on a weekend getaway, banking with us is always at your fingertips. Call or text us whenever you need anything for a fast and easy service on-the-go.

ACU of Texas' Digital Banking access helps you manage your account anytime, from almost anywhere.

Enroll in a few simple steps. You'll need your account number. Once you're set up, download our Mobile App for convenient access.

With Digital Banking you can:

Jump-start your account setup by having all or part of your check deposited to your checking or savings account every month. Plus, you'll get paid up to two days early!

Set up direct deposit today to get your paycheck up to two days sooner!

We're committed to helping you manage your finances conveniently and securely. One of the key tools for staying informed about your accounts is setting up alerts and notifications. Here's why they are important and how you can get started:

Setting up alerts and notifications is a great way to take control of your finances and protect your accounts. If you have any questions or need assistance with this process, don't hesitate to reach out to us.

At ACU of Texas, we understand the importance of accessibility and convenience when it comes to managing your finances. While we offer tons of convenient digital products, we know sometimes you need to withdraw cash, speak to a financial expert face-to-face, or access other in-person banking services.

You can always visit us online to access our ATM and branch locator to guide you to the nearest, most convenient locations and help you find one of more than 55,000 fee-free ATMs in our network.

At ACU of Texas, we strive to make your banking experience as smooth and hassle-free as possible. To help with that, we've compiled a comprehensive list of Frequently Asked Questions (FAQs) to address common inquiries and concerns.

Find answers to Frequently Asked Questions.

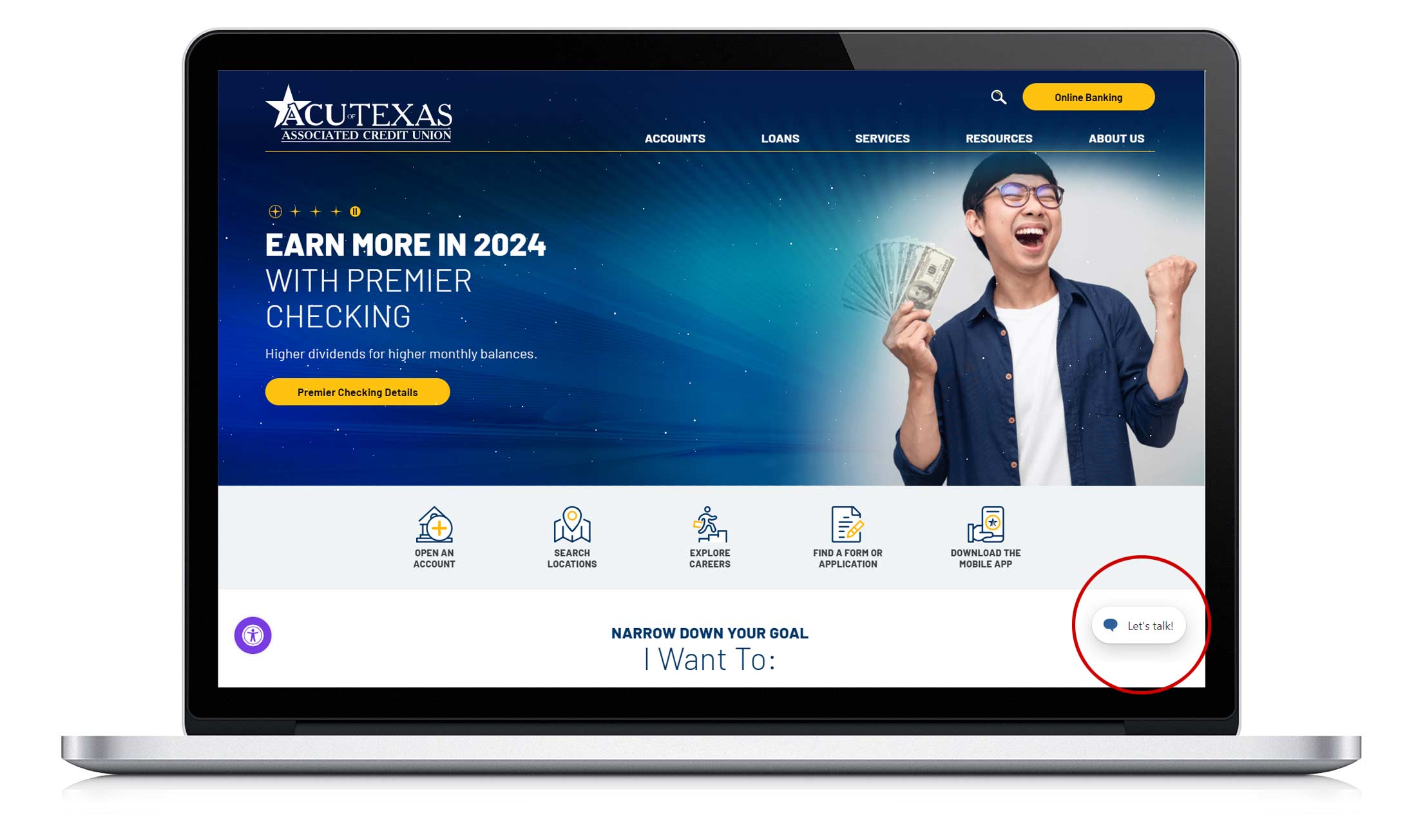

If you have questions or need help, click the chat icon found on the bottom right-hand corner of the page to connect with a member service representative.

When you become an Associated Credit Union of Texas member, you become part of everything we do to improve the quality of life in our community.

Last year, we provided $5,923,116 in savings to our members, saving each household approximately $281.

ACU provides all the services I need. I live 250 miles from any ACU offices, however I’m able to do all my banking from home. I’m very pleased to be a member of ACU. I have used the phone many times and have had all my questions addressed. ACU fills in all the gaps for my banking needs.John – Member

The ACU of Texas Mobile app allows you to view your transaction history and account balances, pay bills, make transfers and locate our nearest ATMs and branches!