- Log In Fast

- Manage It All

- Deposit From Anywhere

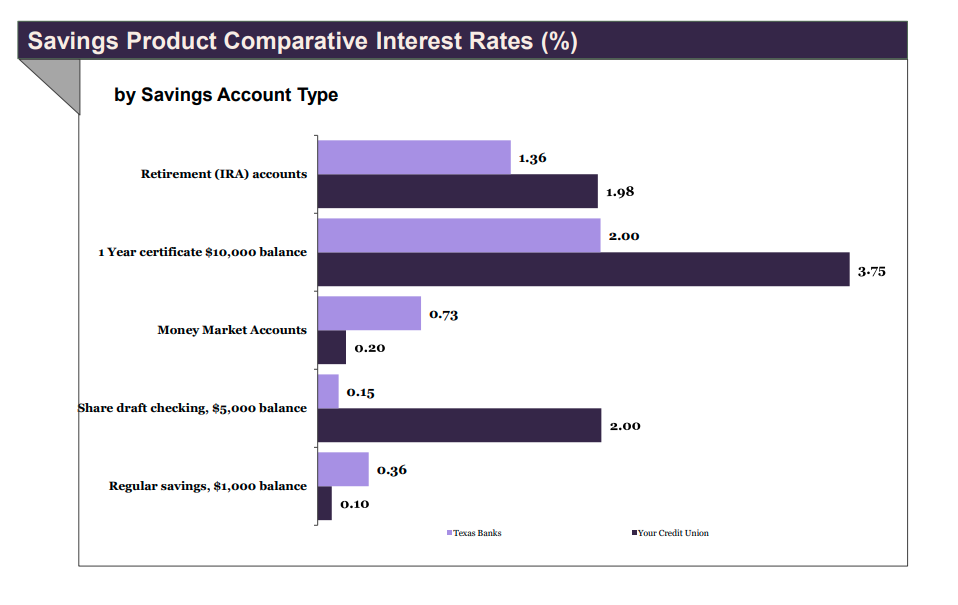

Credit unions generally provide financial benefits to members through lower loan rates, higher savings rates, and fewer fees than banking institutions.

America’s Credit Unions estimates that ACU of Texas provided $5,923,116 in direct financial benefits to its 44,215 members during the twelve months ending March 20241.

These benefits are equivalent to $134 per member or $281 per member household2.

The per-member and per-household member benefits delivered by ACU of Texas are substantial. But, these benefits are reported as averages. Mathematically, that means the total benefits you provide are divided across all members (or all member households) - even those who conduct very little financial business with the credit union.

For example, financing a $30,000 new automobile for 60 months at ACU of Texas will save members an average -$43 per year in interest expense compared to what they would pay at a banking institution in the state. That’s approximately -$215 in savings over 5 years.

Further, loyal members3 - those who use the credit union extensively - often receive total financial benefits that are much greater than the average.

America's Credit Unions estimates that ACU of Texas provided loyal high-use member households $755 in direct financial benefits during the twelve month period.

ACU of Texas excels in providing member benefits in many loan and savings products. In particular, ACU of Texas offers lower loan rates on the following accounts: used car loans, credit cards loans. ACU of Texas also pays its members higher dividends on the following accounts: share draft checking, certificate accounts, IRAs.

1Rates and fees as of 07/08/2024

2Assumes 2.1 credit union members per household.

3A "loyal member" is assumed to have a $30,000, 60-month new auto loan, a classic credit card with an average balance of $5,000, a $200,000, 30-year fixed rate mortgage (a 30-year fixed rate mortgage is replaced with a 5-year adjustable rate mortgage if it yields a greater benefit as it is assumed more in demand), $5,000 in an interest/dividend checking account, $10,000 in a one-year certificate account, and $2,500 in a money market account.

When you become an Associated Credit Union of Texas member, you become part of everything we do to improve the quality of life in our community.

Last year, we provided $5,923,116 in savings to our members, saving each household approximately $281.

ACU provides all the services I need. I live 250 miles from any ACU offices, however I’m able to do all my banking from home. I’m very pleased to be a member of ACU. I have used the phone many times and have had all my questions addressed. ACU fills in all the gaps for my banking needs.John – Member

The ACU of Texas Mobile app allows you to view your transaction history and account balances, pay bills, make transfers and locate our nearest ATMs and branches!